JITO Restaking Protocol

JITO RE-STAKING PROTOCOL

What is Jito?

Jito is a leading project in the Solana ecosystem, primarily known for its Maximum Extractable Value (MEV)-powered liquid staking solution. MEV refers to the additional rewards earned by reordering transactions within a block, typically captured by validators and MEV bots. Jito ensures these MEV rewards are redistributed to users who stake their SOL tokens.

What is Jito Re-staking?

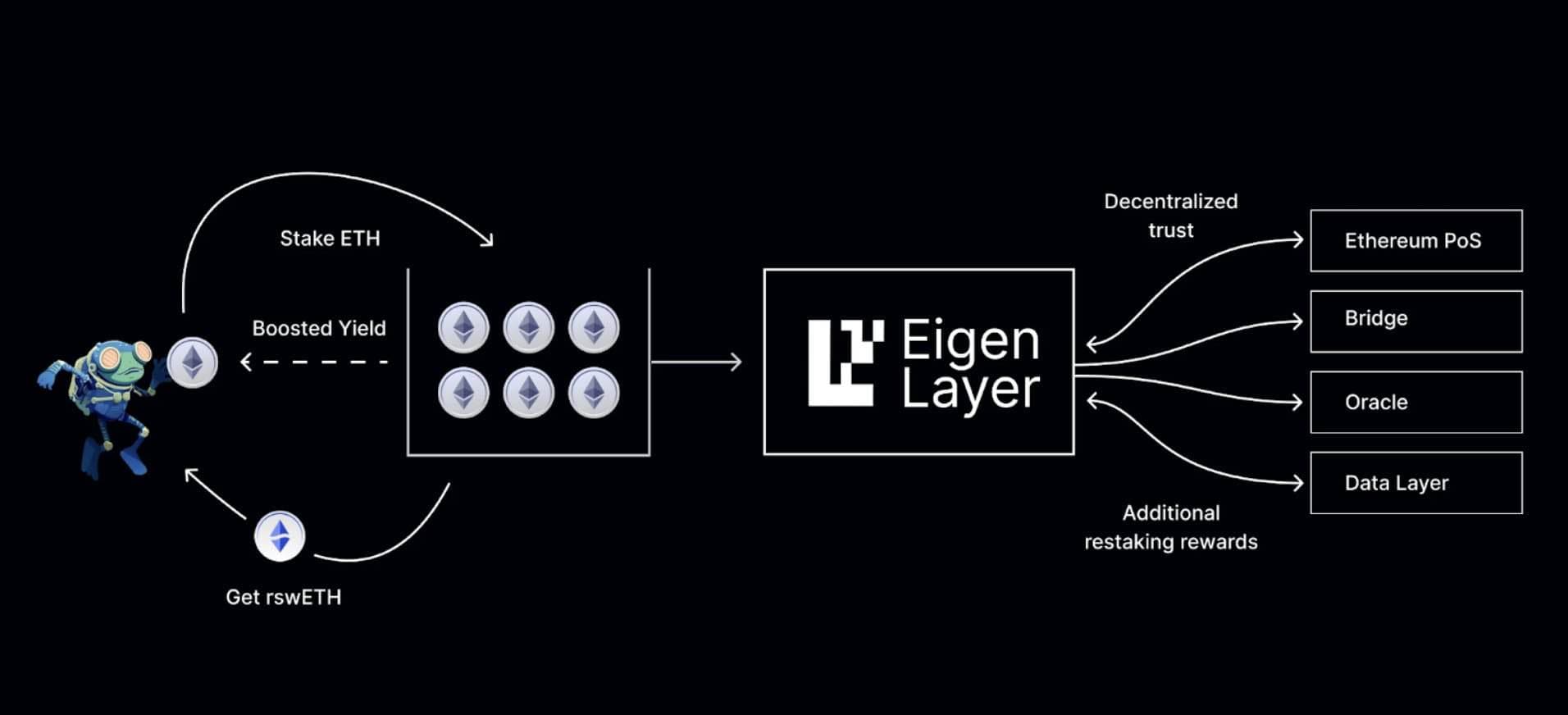

Jito Re-staking enables extending the security of staked tokens to multiple networks without additional effort or capital, supporting on-chain or off-chain applications on Solana.

Jito Re-staking unlocks supercharged rewards for staked SOL/SPL tokens through extra network activities, further decentralizing and securing Solana blockchain, empowering new use cases, and amplifying economic security. Leveraging EigenLayer's pioneering concept, Jito Re-staking revolutionizes staking, enhances validator participation, and fosters a robust, decentralized ecosystem.

While this may not sound too important, it is actually a big deal and is currently seen as one of the most promising innovations of this cycle.

That is the illustrative example of how re-staking work in practice.

The Jito (Re)staking framework consists of two main components: the Restaking Program and the Vault Program. These two entities work together to provide a flexible, scalable infrastructure for creating and managing staked assets, VRTs (Vault Receipt Tokens), and NCNs (Node Consensus Operators).

Key Components:

- Restaking Program: Infrastructure for creating and managing staked assets, similar to EigenLayer (Solana's core re-staking protocol).

- Vault Program: Manages liquid restaking tokens (VRTs) and customizes restaking strategies via DAOs or automation protocols, acting as an intermediary liquidity layer, similar to EtherFi.

Terminology:

- VRTs (Vault Receipt Tokens): Jito's terminology for liquid restaking tokens (LRTs).

- NCNs (Node Consensus Operators): Entities leveraging Jito’s re-staking solution, also referred to as Actively Validated Services (AVS) in EigenLayer.

Image describing how vault program will work.

5 Key Benefits of Jito Re-Staking

Here are five compelling reasons to leverage Jito Restaking:

1. Boost Your Yields with Compound Interest

Jito Restaking optimizes your yields by automatically restaking rewards, generating compound interest and accelerating your wealth growth.

2. Effortless Management: Automate Your Staking

Say goodbye to manual staking and restaking. Jito Restaking streamlines the process, saving you time and effort.

3. Diversify and Reduce Risk

Spread your risk with diversified staking portfolios, ensuring maximum returns while minimizing potential losses.

4. Transparency and Security

Enjoy real-time tracking of rewards and balances, with secure and audited smart contracts protecting your assets.

5. Flexibility and Liquidity

Unstake or withdraw rewards at any time, maintaining control over your assets while optimizing yields.

Jito Use for Stakers

When you deposit your SOL and stake it on the Jito platform, you receive a liquid staking token called JitoSOL in return. This token represents your staked SOL and offers several benefits.

JitoSOL in DeFi

JitoSOL can be used across various DeFi protocols for activities like lending and providing liquidity.

Lend:

You can earn by lending JitoSOL on platforms like Drift, MarginFi, and Solend.

Provide Liquidity:

You can also earn additional income by providing liquidity with JitoSOL on decentralized exchanges (DEXes) such as Orca, Kamino, and Raydium.

Conclusion

Jito (Re)staking is the next big step, it stands on the giant shoulders of staking and liquid staking to create more efficient and secure networks. It allows developers to use existing economies, speeding up the development of new applications. Are you looking to maximize cryptocurrency yields and grow your wealth? Jito Re-staking is a game-changer. Take your cryptocurrency investments to the next level with jito Re-staking.

Optimize Your Yields Today!

Let us help you safely launch your NFT project